test

2025/03/05

Previous Lender Downfalls as well as the Federal Regulatory Effect

キーワード:未分類

Posts

All associations that have part organizations are required to fill out the newest survey; organizations with just a main workplace is actually excused. MMFs had been in addition to effective traders in the debt granted because of the Government https://vogueplay.com/ca/netbet-casino/ Financial Banks (FHLBs), improving the holdings from FHLB debt securities from 9% so you can a dozen% out of overall money property in the 1st quarter from 2023. MMFs experienced collective inflows of $step one.dos trillion inside the 2023, the biggest to the checklist. U.S. currency market money (MMF) is a significant way to obtain small-identity investment to the economic climate while they invest higher dollars balances and you will hold primarily brief-identity assets.

Area 482.—Allocation cash and you may Deductions Among Taxpayers

Dividends to the half a dozen-day certificates are attained on the a straightforward (maybe not material) attention base and so are paid back if the certificate grows up. I rated Quontic Lender Certification out of Deposit very for the best three-seasons Cds as the its three-season certification pays step 3.25% APY—probably one of the most aggressive rates for that name solution. Quontic’s costs for the all words is actually close to the better production readily available, and also the on the internet lender makes it simple to open up a Video game in minutes. Large long-term efficiency for the Basic National Bank’s Dvds is generally right for those people trying to lock in income more than long periods.

Putting in a bid for Silicon Area Private Bank and SV Link Lender finalized for the February twenty four. The new FDIC obtained 27 bids away from 18 bidders, along with bids underneath the whole-bank, private lender, and you will investment profile alternatives. To your February 26, the fresh FDIC accepted Earliest-People Lender & Faith Company (First-Citizens), Raleigh, New york, because the effective buyer to imagine all of the deposits and you can finance from SV Bridge Bank. The new 17 former twigs out of SV Link Bank within the California and you can Massachusetts reopened because the Basic-Owners to the February 27.

$1 Deposit Local casino Tips

Team during the Board and also the Put aside Financial institutions make a wide directory of logical performs you to definitely examines the state of the fresh You.S. banking system with a specific work with growing threats that is built to provide perspective for policymakers and you will group (see the “Extra Information” section). A glance at one another internal and external issue means that staff known many growing things, such as the feeling from rising rates for the bonds valuation and you will prospective put influences, each of and this ended up associated to possess SVB. SVBFG’s rapid failure will likely be connected directly to its governance, exchangeability, and rate of interest risk-administration inadequacies. An entire board away from directors didn’t found enough information of management in the dangers in the SVBFG and didn’t keep administration guilty. For example, suggestions condition one to management sent the fresh panel failed to correctly stress SVBFG’s liquidity points until November 2022 even after deteriorating criteria.

Brand new reporting. Brave news media. Delivered to you.

Fundamentally, the new remuneration can be regarded as getting paid when a created declaration like the info is actually provided on the workplace by personnel pursuant in order to area 6053(a), as the talked about below. step one Pursuant to § 433(h)(3)(A), the third segment speed computed below § 430(h)(2)(C) is used to search for the newest liability out of a great CSEC bundle (which is used in order to estimate minimal number of the full financing limit under § 433(c)(7)(C)). People deposit of cash, the big event at which is to hold the efficiency from a home-based leasing contract otherwise any part of such a binding agreement, apart from in initial deposit that is exclusively an advance payment out of rent, will likely be influenced from the provisions associated with the part. (1) The newest authored declaration itemizing the causes for the storage of any portion of the protection deposit should be followed by a complete payment of the difference in the safety deposit and also the amount hired. The new landlord should pay no less than four percent yearly attention to the one ruin, shelter, cleaning or landscaping deposit required by a landlord of a renter. The new property owner will both pay the attention per year otherwise substance the fresh desire per year.

What goes on following six-day period?

The new 40 former branches out of Trademark Lender first started working lower than Flagstar Lender, Letter.An excellent., for the Tuesday, February 20. Depositors from Signature Connection Financial, apart from depositors regarding the fresh electronic advantage financial team, automatically turned into depositors of the getting institution. The new obtaining organization didn’t quote for the deposits ones digital resource financial people.

The newest FDIC is offering those people places, approximating $cuatro billion, right to those individuals users. My personal testimony now have a tendency to determine the fresh occurrences leading up to the new failure out of SVB and you may Signature Financial plus the things and items one to motivated the choice to utilize the expert on the FDI Work to guard all depositors when it comes to those banking institutions following these downfalls. I’m able to as well as discuss the FDIC’s assessment of the current state of the You.S. economic climate, and this stays voice despite current occurrences. Concurrently, I can share certain original training discovered as we look back to the quick wake of this episode. Banking institutions with assets regarding the $ten billion to help you $one hundred billion variety is actually watched within the Local Financial Company, or RBO, collection. Banks having property of lower than $ten billion try supervised inside People Banking Business, otherwise CBO, profile.

So that the judge’s purchase requires earplug claimants and their attorney to reveal all the third-team legal actions funding preparations on the courtroom so you can and make certain you to definitely he is fair and you may sensible. Their ability to interfere inside the a 3rd-team package under state laws is a bit hazy – but she actually is a national judge legal and that comes with particular move. To the Tuesday, Legal Rogers granted directives for a few line of sets of plaintiffs.

Organizations that have part practices must complete the brand new questionnaire to help you the newest FDIC from the July 29, 2023. Establishments with just a main work environment is exempt; but not, they shall be as part of the questionnaire overall performance in accordance with the overall places advertised on the Summer Name Report. Publication of your survey information is dependent on punctual and you may direct processing from the respondent organizations; thus, zero processing extensions was granted. The newest MMF Monitor suggests $1.2 trillion otherwise 22% net rise in assets inside 2023, that have authorities financing attracting more than about three-household out of internet the fresh dollars. About 40% out of internet inflows took place February 2023, since the concern about the safety from dumps after the collapse from a few regional banks prompted traders to reallocate $480 billion to MMFs—next largest you to definitely-month increase to the checklist.

Recently, I was selected Treasurer of your own People from Top-notch Reporters’ SDX Base (Arizona, DC chapter), increasing grant currency to have ambitious young reporters. Matthew are a senior individual banking reporter with over a couple ages from journalism and you can economic services options, providing members build told conclusion regarding their personal finance requires. His banking career comes with being an excellent banker within the Nyc and you can a bank administrator in the one of several country’s prominent banking companies. Matthew is currently a member of your own Panel away from Governors during the the newest Area to own Moving forward Team Editing and you can Composing (SABEW), chairing its knowledge representative engagement panel which can be co-couch of the Fund Committee. Our banking editorial people continuously assesses research away from over a great hundred or so of your own best creditors across a selection of classes (brick-and-mortar financial institutions, on the web banks, credit unions and a lot more) to discover alternatives that actually work good for you. Marcus by Goldman Sachs offers Video game conditions between six months to help you half a dozen decades, plus the lowest necessary starting deposit out of $five-hundred is leaner than what some other banking institutions charges.

United states rules remains according to realizing and strengthening a great democratic, prosperous, an initial recipient from FSA direction. You assistance to Ukraine is targeted to promote political and you can monetary reform and also to target immediate humanitarian demands. The usa have constantly advised Ukraine’s transition to a popular community that have a booming industry-centered savings. Russian county news stated one to Russian team “Kaysant” establish a system to shield Russian armored vehicle out of first person attention (FPV) drones.71 A good Kaysant associate stated that the firm install a good dome-type of drone jammer designed for set up to your vehicle and you can weighs in at simply a few kilograms. The machine apparently jams drones in the 800 and you can 900 megahertz wavelengths, and you can Kaysant intentions to generate similar options that will run using three or four wavelengths. Kaysant apparently first started creation of this type of solutions and had obtained purchases in the Moscow regulators, there are discusses mass deliveries ones solutions on the frontlines.

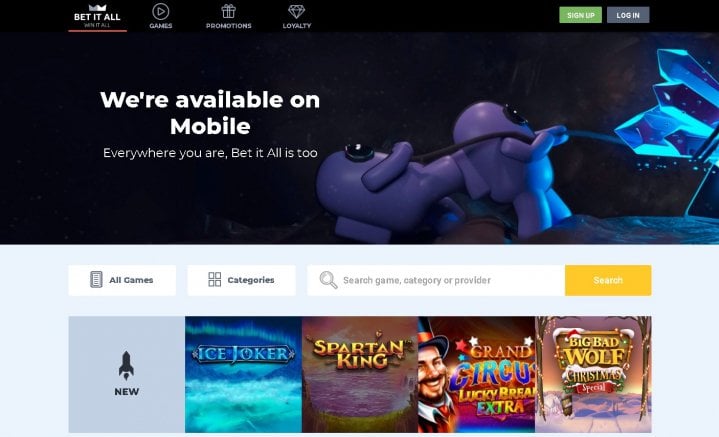

What’s a minimum Put Gambling establishment?

SVBFG’s internal risk urges metrics, which were place by the the board, given minimal visibility to your its vulnerabilities. In fact, SVBFG got broken its enough time-label IRR limitations on and off because the 2017 because of the architectural mismatch between enough time-duration securities and you may small-duration deposits. In the April 2022, SVBFG produced counterintuitive modeling presumptions regarding the lifetime of dumps to help you address the new restrict violation as opposed to managing the real exposure. Across the same several months, SVBFG as well as removed interest rate hedges who does provides protected from rising rates of interest. Inside contribution, whenever ascending rates of interest endangered profits and you can shorter the value of the bonds, SVBFG administration got steps to maintain brief-identity profits rather than effortlessly create the underlying harmony layer risks.

Since December 31, 2022, the former Signature Bank got total dumps of $88.6 billion and you can overall assets of $110.4 billion. The order with Flagstar Bank, N.A., integrated the acquisition of approximately $38.4 billion away from Trademark Link Bank’s assets, and finance of $12.9 billion bought at an economy out of $dos.7 billion. As much as $60 billion within the financing will continue to be on the receivership for later on feeling because of the FDIC. Simultaneously, the fresh FDIC gotten guarantee love rights inside the Ny Neighborhood Bancorp, Inc., well-known inventory having a prospective worth of to $300 million. Across the same months, underneath the advice of the Vice Chair to own Oversight, supervisory techniques moved on. On the interview because of it report, staff repeatedly mentioned changes in standard and you will strategies, as well as tension to attenuate weight to the organizations, meet a higher burden from facts to possess a supervisory completion, and you may have demostrated owed processes when it comes to supervisory actions.