test

2024/08/16

What is periodicity in accounting?

キーワード:未分類

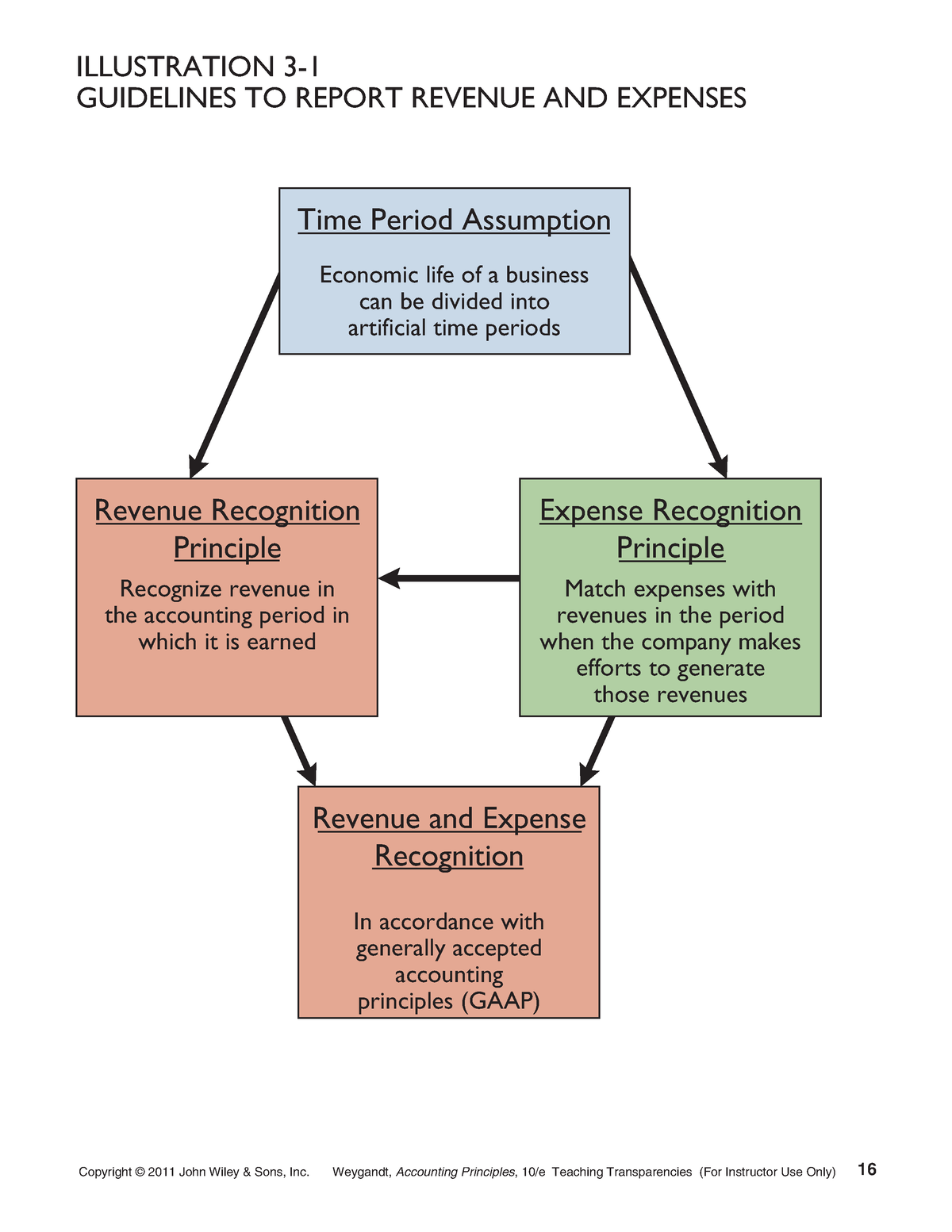

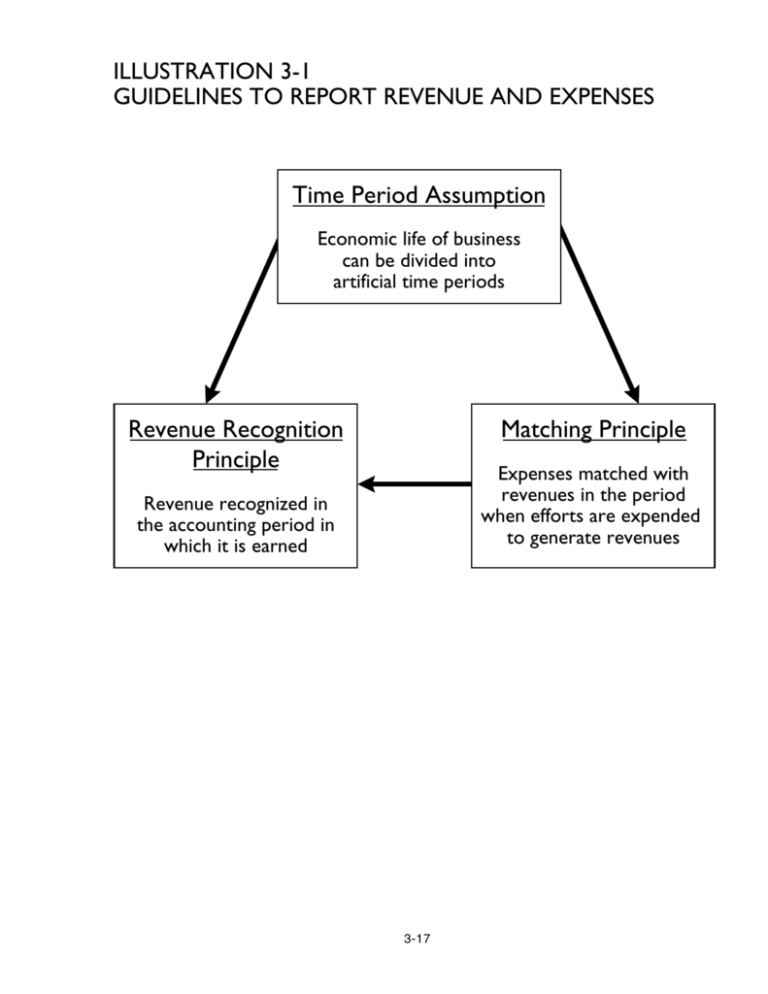

While the time period assumption is a cornerstone of financial reporting, it must be applied judiciously, considering its interplay with other accounting principles. Accountants must balance the need for periodic reporting with the goal of presenting a fair and complete picture of an organization’s financial health. The time period assumption allows the company to recognize revenue and expenses related to the project incrementally. This is often done using the percentage-of-completion method, where revenue is recognized based on the project’s progress, providing a more accurate picture of financial performance over specific time frames. The concept of time plays a pivotal role in the recognition of revenue, serving as a fundamental axis upon which the entire edifice of accrual accounting is constructed.

The 4 Basic Accounting Assumptions

For instance, a retail company might analyze monthly sales data to identify seasonal trends and adjust inventory levels accordingly. The time period assumption has a profound impact on financial statements, influencing everything from day-to-day bookkeeping to strategic decision-making. It ensures that financial information is presented in a manner that is both meaningful and useful for all stakeholders involved. Regulatory bodies, such as the securities and Exchange commission (SEC), require public companies to follow GAAP to prevent fraudulent reporting and financial misrepresentation.

Why do companies use time period assumptions?

- Quantifiability means that records should be stated in terms of money, usually in the currency of the country where the financial statements are prepared.

- Investors and creditors want the most current information possible to base their financial decisions on.

- The annual reporting cycle provides a comprehensive overview of the company’s activities over the past year, including detailed financial statements and management’s discussion and analysis.

- For example, consider a company that enters into a contract in December but doesn’t deliver the goods or services until January of the following year.

- Regulatory bodies, such as the securities and Exchange commission (SEC), require public companies to follow GAAP to prevent fraudulent reporting and financial misrepresentation.

Despite these benefits, it’s important to remember that dividing a business’s life into time periods is an artificial construct. Some business activities span multiple time periods, and allocating these activities to a single time period can be somewhat arbitrary. But despite this limitation, the periodicity assumption is a fundamental concept in accounting that helps to provide timely and relevant financial information. Time period assumptions are used to provide a more accurate picture of the value of assets and liabilities held for long periods and how business is doing throughout each month or quarter. Readers can see that there is $100 million in total revenue, but they don’t know much about how it was earned or what months were particularly strong or weak.

How Are Financial Statements Presented in Accordance With GAAP?

However, at the viewpoint of accounting, the owner and the proprietorship business are still considered as two separate entities, with their transactions being accounted for separately. Basic Accounting Assumptions are fundamental concepts and guidelines under which the financial statements are prepared. The Monetary Unit Assumption states that all business transactions must be measured and recorded only in terms of a common unit of measurement which is money. Debitoor invoicing software aims to help you comply with accounting principles by using an automated system to match your transactions as easily and quickly as possible. One of the features in our larger subscription plans allows you to upload your bank statements which will automatically match each payment to the corresponding invoice or expense. An example of this is depreciation for equipment expenses, which depends on the estimated number of years which the fixed asset will be functioning and in use.

This assumption is crucial because it allows businesses to measure performance and financial status in shorter, more manageable intervals rather than over the entire lifespan of the company. However, the application of this assumption is not without its challenges and nuances, which can be best understood through various case studies. All accounting entries should be recording on the balance sheet or income statement in the correct time period.

Future of Time Period Assumption in the Evolving Accounting Landscape

The assumption’s practical application underscores its significance in the realm of accounting and financial reporting. Time period assumption is the period in which businesses divide ongoing business into shorter periods to prepare the financial statements. The business operation will continue for a long time, but accountant needs to prepare financial statements for the management to make a proper and timely decision. Annual reports are usually called the physical year, and any report less than that is called an interim report. what are different types of standards under standard costing is an accounting principle that divides a company’s financial activities into specific, discrete time periods such as months, quarters, or years. The time period assumption is a fundamental concept in accounting that enables organizations to communicate their financial activities within a specific period.

The time period assumption (also known as periodicity assumption and accounting time period concept) states that the life of a business can be divided into equal time periods. These time periods are known as accounting periods for which companies prepare their financial statements to be used by various internal and external parties and stakeholders. From a legal standpoint, the time period assumption requires companies to adhere strictly to reporting schedules mandated by regulatory bodies.

For instance, publicly traded companies are often required to submit quarterly and annual reports to entities such as the Securities and Exchange Commission (SEC) in the United States. Failure to comply with these reporting periods can result in legal repercussions, including fines and penalties. Moreover, the assumption impacts the recognition of revenue and expenses, which in turn affects tax liabilities. Tax authorities may scrutinize the timing of these recognitions to ensure compliance with tax laws.

By examining financial statements for different periods, they can identify trends, measure performance, and compare a company’s financial health against its competitors. This temporal breakdown of data is indispensable for performing ratio analysis, forecasting future performance, and valuing companies. The accounting period will reflect the amount of revenue and expense recording within each period.

The time period principle is the concept that a business should report the financial results of its activities over a standard time period, which is usually monthly, quarterly, or annually. Once the duration of each reporting period is established, use the guidelines of Generally Accepted Accounting Principles or International Financial Reporting Standards to record transactions within each period. Even though the going concern assumption dictates that businesses should be treated as if they will continue indefinitely, it is helpful to view business performance in shorter time frames. The periodicity assumption is important to financial accounting because it allows businesses to show current performance to investors and creditors for shorter periods of time.