test

2024/04/09

Trial Balance Example Format How to Prepare Template Definition

キーワード:未分類

The Income Summary account would have a credit balance of 1,060 (9,850 credit in the first entry and 8,790 debit in the second). You record all your accounting transactions and post them to the general ledger, then assess the debit and credit totals. The balance sheet is classifying the accounts by type ofaccounts, assets and contra assets, liabilities, and equity. Even though they are the samenumbers in the accounts, the totals on the worksheet and the totalson the balance sheet will be different because of the differentpresentation methods.

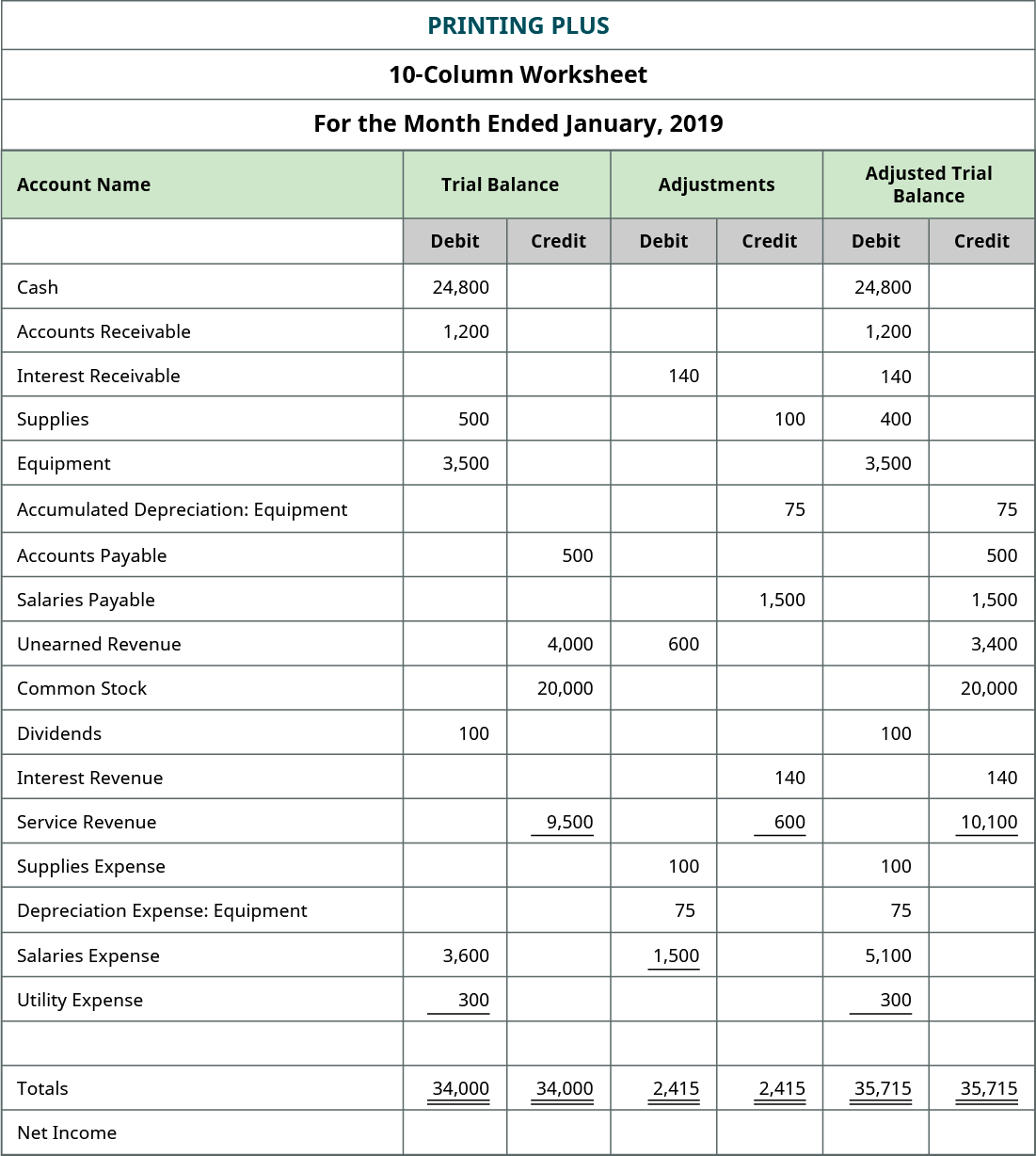

Ten-Column Worksheets

Adjusted trial balance – This is prepared after adjusting entries are made and posted. Its purpose is to test the equality between debits and credits after adjusting entries are prepared. For example, Cash has a final balance of $24,800 on the debit side. This balance is transferred to the Cash account in the debit column on the unadjusted trial balance.

- This ending retained earnings balance is transferred to the balance sheet.

- If an account has a zero balance, there is no need to list it on the trial balance.

- Financial statements drawn on the basis of this version of trial balance generally comply with major accounting frameworks, like GAAP and IFRS.

- If we go back and look at the trial balance for PrintingPlus, we see that the trial balance shows debits and credits equalto $34,000.

- The trial balance information for Printing Plus is shown previously.

Magnificent Adjusted Trial Balance

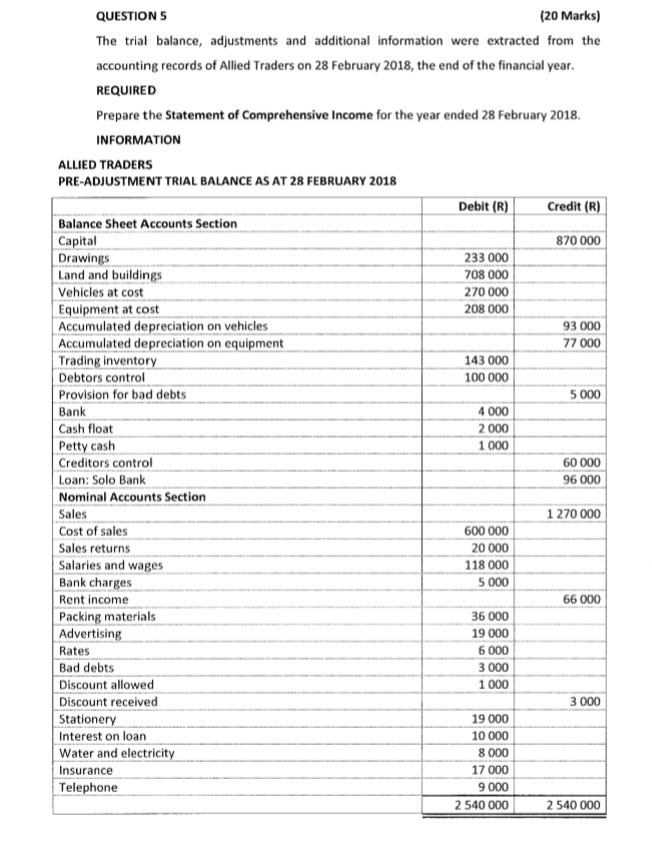

A trial balance sheet, which in itself, is a complete summary of an organization’s transaction gives a clearer picture of it when adjusted to such expenses. After adjusting entries are made, an adjusted trial balance can be prepared. Note that only active accounts that will appear on the financial statements must to be listed on the trial balance. If an account has a zero balance, there is no need to list it on the trial balance. There’s also a chance it’ll fail to flag entries incorrectly coded to the wrong accounts, which can ultimately lead to inaccurate financial statements. In other words, a trial balance shows a summary of how much Cash, Accounts Receivable, Supplies, and all other accounts the company has after the posting process.

Post-Closing Trial Balance Example

The balances of the nominal accounts (income, expense, and withdrawal accounts) have been absorbed by the capital account – Mr. Gray, Capital. Hence, you will not see any nominal account in the post-closing trial balance. Nominal accounts are those that are found in the income statement, and withdrawals. A trial balance plays a major role in the accounting cycle, notably at the end of an accounting period before generating financial statements. A trial balance is an internal report that itemizes the closing balance of each of your accounting accounts. It acts as an auditing tool, while a balance sheet is a formal financial statement.

The total overreported income was approximately $200–$250 million. This gross misreporting misled investors and led to the removal of Celadon Group from the New York Stock Exchange. Not only did this negatively impact Celadon Group’s stock price and lead to criminal investigations, but investors and lenders were left to wonder what might happen to their investment. We get clear information from trial balance about debit entries and credit entries.

Locating Errors

Next you will take all of the figures in the adjusted trialbalance columns and carry them over to either the income statement columns or the balancesheet columns. There is a worksheet approach a company may use to make sure end-of-period adjustments translate to the correct financial statements. Both ways are useful depending on the site of the company and chart of accounts being used. And finally, in the fourth entry the drawing account is closed to the capital account. At this point, the balance of the capital account would be 7,260 (13,200 credit balance, plus 1,060 credited in the third closing entry, and minus 7,000 debited in the fourth entry). After posting the above entries, all the nominal accounts would zero-out, hence the term “closing entries”.

The balance of Accounts Receivable is increased to $3,700, i.e. $3,400 unadjusted balance plus $300 adjustment. Service Revenue will now be $9,850 from the unadjusted balance of $9,550. spotify for public or commercial use Tax accountants and auditors also use this report to prepare tax returns and begin the audit process. The adjustments need to be made in the trial balance for the above details.

For example, if a company had a vehicle at the beginning of the year and sold it before year-end, the vehicle account would not show up on the year-end report because it’s not an active account. Since temporary accounts are already closed at this point, the post-closing trial balance will not include income, expense, and withdrawal accounts. It will only include balance sheet accounts, a.k.a. real or permanent accounts. By providing a snapshot of all ledger accounts within a given accounting period, the trial balance helps business owners and accounting teams in reviewing accuracy.